Printable PDF version

Subscribe to our newsletter

Mass Timber Construction

AI in Construction

Tariffs & Escalation

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430 (San Francisco office)

6518 Lonetree Blvd., Suite 164

Rocklin, CA 95765

(916) 742-1770 (Sacramento office)

8910 University Center Lane, Suite 1100

San Diego, CA 92123

(619) 814-6793 (San Diego office)

8538 173rd Avenue NE

Redmond, WA 98052

(206) 571-0128 (Seattle office)

2063 Grant Road

Los Altos, CA 94024

(650) 386-1728 (South Bay office)

7083 Hollywood Blvd., 4th Floor

Los Angeles, CA 90028

(424) 343-2652 (Los Angeles, CA office)

78 Heathervue, Greystones

Wicklow, A63Y997, Ireland

+353 86-600-1352 (Europe office)

www.TBDconsultants.com

Timber is moving up in the world. Once limited to housing and other low-rise construction, timber is being utilized in mid-rise and high-rise buildings, and here we look at the technology driving this change.

Artificial Intelligence has been talked about for decades, but it had been looking as if it would never really arrive. But now it is finding it's way into industry and commerce, and even our private lives. Here we look at how it is starting to affect the construction industry.

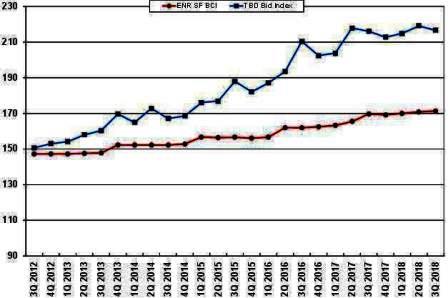

Construction prices have been driven to new record highs over the past few years by the fact that the volume of construction has been putting pressure on the capacities of contractors to meet the demand. It has become hard to get multiple contractors, and especially subcontractors, to bid on projects, reducing the level of competition with an inevitable rise in bid prices. The contractors have to cover the risks of having to pay higher prices for resources, and they also have little incentive to keep their profit margins low.

Prices for construction labor and materials have continued to rise, but only at a rate approximating that of the Consumer Price Index, so while they have contributed to the rise in bid prices, their effects have been small. Then in 2017 we saw the imposition of roughly 20% tariffs on Canadian lumber, and this year has seen 25% tariffs on imported steel and 10% on aluminum, and these are putting more pressure on bid prices.

Looking at steel, the effects of the tariffs adds about $300 to the material costs. Assuming the installed cost of structural steel members was about $4000/ton, then the percentage increase works out at 7.5%. Then say that steel constitutes about 16% of the cost of a commercial building, and it gives an increase on the bid price of 1.2%, and to that would be added increases related to timber and aluminum tariffs.

The initial effects of the increases would have been muted by materials suppliers stockpiling as soon as tariffs were proposed, and likewise contractors locking-in their orders as soon as possible. On the other hand, increases in some materials were seen ahead of the actual tariffs, in anticipation of the rising prices. There was little incentive on suppliers to carry any increases themselves.

The tit-for-tat retaliation as one side or the other imposes tariffs has only increased the risk situation for contractors, when their construction contract probably doesn’t allow them to recoup price increases, and the contractors’ books are already full.

In summary, the tariffs will inevitably add something to the inflationary pressures, the main effect is more likely to result from the uncertainty surrounding where tariffs will go next, making the bidding market even more precarious.

Geoff Canham, Editor, TBD San Francisco

Design consultant: Katie Levine of Vallance, Inc.