Printable PDF version

Subscribe to our newsletter

Market Conditions Update

Preconstruction

Services, Part 2

Green Concrete

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430

www.TBDconsultants.com

Market

Conditions Update

Gordon

Beveridge

Market Trends

For most contractors, 2007 and the proceeding two years were the best of times in almost all sectors. However, before the end of 2007, the wheels had started to come off the housing market and the biotech markets. Both of these markets continue to lag, with no optimistic forecast to anticipate any turn around in these sectors in the coming year (2008) or in 2009.

The troubled waters in the housing/financing market has had serious ripples on the economy and it is still not certain that we have entered a recession as measured by the general economy statistics nationwide, but there is enough uncertainty to get everyone's attention and focus.

However, so far this year (writing in June 2008) in the Bay Area almost all other sectors have been holding up, as measured in terms of construction in place. In particular, the lodging and healthcare markets continue to be very strong, with healthcare leading the field.

The mood in the construction market is, however, becoming cautionary, with financing becoming tighter and a migration of the labor market from housing to other sectors. This has been evident especially at the subcontract level on smaller projects. The competition on the lower end ($10-40M) has become fierce. As a result, some bids are coming in 15-20% below where the market was 7-8 months ago. This is primarily as a result of the competition at the sub-trade level. It is now common on these projects to have 5-6 bidders or more in each trade compared to one or two some 7-8 months. There is an urgency to build up a backlog now before the economy may turn down further.

What has become clear is that commodity prices have a life of their own. Only certain products can be classified as stable as a result of the housing slowdown e.g. lumber and drywall. The majority of materials are subject to the world wide swings in global demand and exchange rates. As a result it is still not the case that escalation of raw materials is under control or can be predicted. Recent examples of rampant gyrations have been steel and oil prices. It is prudent for the subject of this risk to be addressed by the owner and contractor in order to identify materials that can be bought out at an early stage. Paying for storage or holding charges may help to allay the risk of future buy-out.

The enormous healthcare market remains the biggest driver for many large contractors. There remains a dearth of contractors/subcontractors with the experience and availability to tackle the avalanche of healthcare work currently in the design/preconstruction phases. This position does not look like changing anytime soon. The lack of competition has encouraged changes in procurement to entice interest in this market and secure subcontractors at an early stage. However, the MEP trades are already saturated with work, and as a result owners may have to accept that bids in these trades will not be as competitive as desired. Owners would be well advised to carry a bidding contingency for these impacted building systems.

Escalation

The tracking of escalation typically falls into two categories, the tracking of raw costs of material and or labor, or the actual in place costs as measured by bids received.

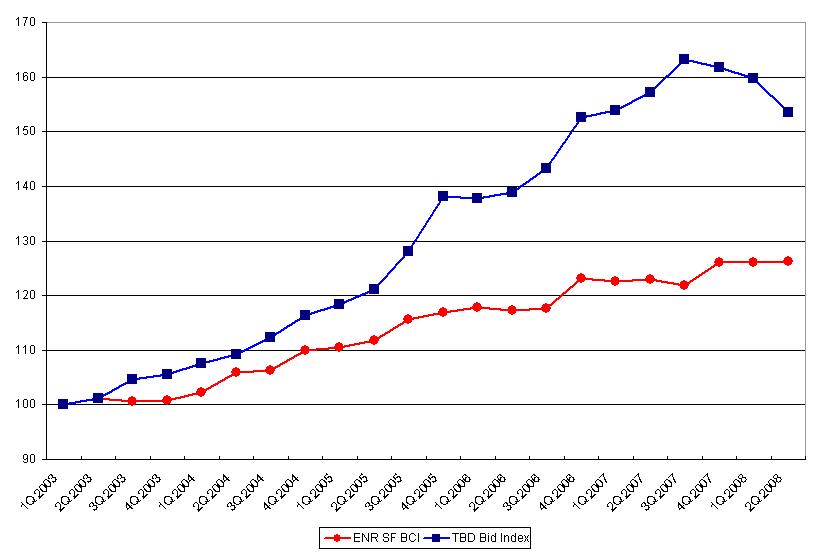

TBD has developed an index based on pricing the same project (a school building) every three months based on market prices at that time. This method captures the Bay Area market rather than some homogenous national index which is a compendium of all regions, and the current TBD Bid Index is as follows:

The above reflects the following historical escalation from the TBD Bid Index:

| Year | Escalation |

| 2003 | 7.62% |

| 2004 | 10.01% |

| 2005 | 16.39% |

| 2006 | 11.67% |

| 2007 | 3.86% |

Market research has indicated that future escalation trends will be down from the previous three years. Currently we are predicting the following escalation amounts:

| Year | Escalation |

| 2008 | 0 - 5% |

| 2009 | 4 – 5.5% |

| 2010 | 5 - 6% |

| 2011 | 5 - 6% |

Particularly over the coming year, as described above we expect the market conditions to vary substantially depending on size and type of project, and so the above percentages are given as an approximate average over all projects.

We mentioned oil prices earlier, and for its impact on a specialty construction market we only have to look at the Caltrans Asphalt Paving Price Index. This tracks the unit rates for asphalt paving in place, and shows an increase of 225% from January 2007 to June 2008!!!

Preconstruction Services, Part 2

Matt

Craske

Matt continues his look at the preconstruction services associated with the GMP delivery method, including value engineering, risk management, constructability reviews, and more.

Do you know how much carbon dioxide is produced from concrete production? Probably more than you suspected. In this article we look at some of the efforts being made to make concrete more environmentally friendly.

Design consultant: Katie Levine of Vallance, Inc.